Last Updated on January 21, 2022

Have you ever feel hesitated in asking the time to split the bills in many ways? Using P2P apps, you don’t need to worry about splitting bills, or a person foots the tab and is paid back by the rest, or deciding the amount will charge on each card.

Peer-to-peer payment platforms, also known as P2P money transfer apps or payment systems, enable users to send or receive money from their mobile devices through a linked debit card, credit card, or bank account. It also helps users to split bills with family and friends seamlessly. The best examples of P2P payment apps are Venmo, Zelle, Cash, Paypal, Google pay, etc.

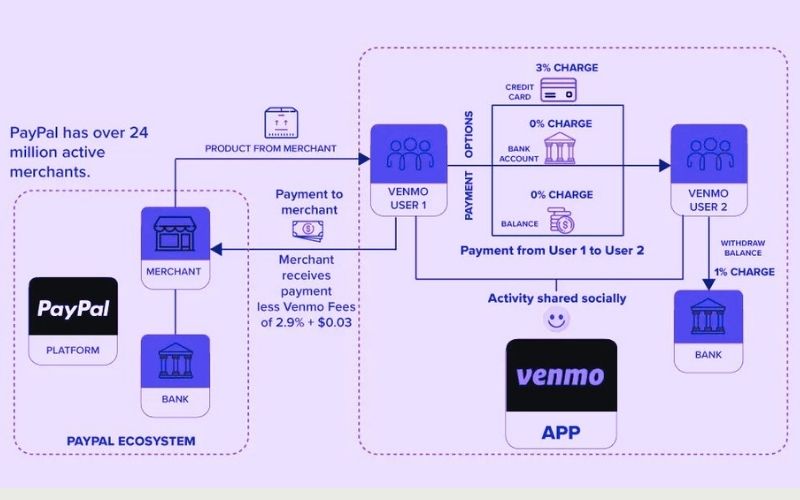

Venmo is a peer-to-peer mobile payments app available for IOS & Android users with user-friendly interfaces. Venmo enables the users to transfer money between each other using the partner company’s app. Users can pay to selected merchants either using the company’s debit card or pay with Venmo features. With this app, one can request money from another and send it unsolicited. So let us first know about Venmo, its working, business model, and more.

What Is Venmo?

- Venmo was founded in 2009 and started as a text-based payment delivery system. In 2012, the company invented the platform with social network integration to capitalize on expanding the p2p economy.

- After less than six months, Braintree’s mobile payment system, used by Uber, Airbnb, and other popular eCommerce brands, acquired the Venmo platform for $26.2 million.

- After Less than a year, when Paypal Holdings Inc. acquired Braintree for $800 million, that resulted in a substantial boost in Venmo users & monetization base.

- Venmo is also well known for the public feed of transactions. It displays a social media feed for transactions in many ways that you may comment or like on these feeds. People use emojis to detail the reason for the transaction.

- Though focusing on personal privacy, you can make your transactions private, and you still need to add a note regardless. Additionally, you can use Venmo on the web for payments. The company announced that feature to roll out in 2018.

How Does Venmo Work?

Transactions via bank account, debit cards, and Venmo balance are free of cost, whereas a standard 3% fee will be applied on credit card transactions.

User doesn’t need to add money to Venmo wallet; whenever someone pays, the funds will be available in Venmo wallet by default, and the user can withdraw it to their bank account. The money will show up in their account on the next business day.

Venmo is easily accessible across contacts and businesses as well. Venmo keeps transactions and app data secure by encryption.

Money that you received on the Venmo app is available for you to make future transactions.

How To Use Venmo to Send Or Receive Money?

- The Venmo app is widespread and easily accessible to users globally. Here are the steps to send or receive money:

- To send money, click on the circular icon from the bottom right corner of the app.

- Choose the person/contact you want to make payment to.

- Please enter the amount and press whether you are paying them or requesting money from them.

- Just above the pay tab, there is a button to display who can review the transaction reasons.

- Choose from private, public, or friends. Later the transaction will be entirely hidden from the timeline.

- Otherwise, by default, the description will be public.

How Does Venmo Make Money?

A small guide to Venmo charges

1. Instant Transfer

This feature was enabled in Venmo from 2019 and turned in a significant revenue stream. Users who don’t want to wait for 1 to 3 days to transfer the Venmo money to their bank balance can instantly transfer it. Venmo charges users a 1% fee on each transaction, with a minimum of $0.25 and a maximum of $10.

2. Cash A Check

In January 2021, Venmo has launched the cashing service. The company charges users a 1% of transaction fee with a min $5 check amount.

3. Pay With Venmo, Venmo Debit Card

This is the major revenue stream of Venmo. The app charges a $0.30 transaction fee and 2.9% merchant fees on every request of payment. It’s similar to visa or MasterCard charges. POS counters that accept MasterCard accept payments from Venmo cards as well.

4. Interchange And Withdrawal Fees

For transaction processing, Venmo charges interchange fees to merchants. While withdrawing the payment from ATM, users need to pay a $2.50 fee and $3.00 fee while withdrawing funds at bank tellers.

5. Cash Interest from Loans

The platform loans cash to the bank from its system in return for an average landing fee of 3.35% in 2019.

6. Cashback Program

Similar to other debit cards, the Venmo platform offers a cashback reward feature with their Venmo card. The reward varies from 1% to 2% of the transaction value. Some partner merchants offering cashback programs include Chevron, Papa Johns, Target, Dunkin’ Donuts, and more.

Amazing Statistics Of Venmo

Find more statistics at Statista

- Over 7 million Venmo users are in the 18-30 years age group.

- In 2019, Venmo had over 50 million active accounts.

- Around 14% of adult Americans use Venmo for P2P transactions.

- Venmo had processed near about $160 billion in total payment in 2020.

- 30% of small businesses even have not heard about Venmo yet

- The average amount transfer on Venmo is $60.

- 60% of Venmo customers are male.

- Emojis make the Venmo payment service unique and necessary for the Venmo experience.

What Are The Top Competitors & Alternative Of Venmo?

- Zelle App

- Cash App

As the use of P2P apps increases slightly, there are many apps available in the market, which creates confusion for users to choose from. The top P2P apps running in the market are Venmo, Zelle, and Cash. Zelle and cash seem tough competitors for Venmo, or if anyone is looking for alternatives to Venmo, then Zelle and Cash are a perfect choice. Let’s discuss how:

Zelle App

This p2p service is offered by most U.S. banks and enables users to transfer payments to other Zelle app users via bank account or through the Zelle app.

How Does Zelle App Works

After a successful account setup on Zelle through the bank or Zelle app, users can pay or request money by filling up another user’s registered phone number or email address. If the recipient user doesn’t own a Zelle account, they need to set up it first to enable send or receiving money.

Advantage Of Zelle App

- Instant Money Transfer

- Zelle is integrated with many credit unions and banks.

Disadvantage Of Zelle App Cons

- Can’t add a credit card

- This platform needs a smartphone to work

- Can’t transfer money to an international bank account

Cash App

Square Inc. created this platform to make money transfers and enable people to send & receive money with their linked debit card, credit card, bank account, and cash app balance. The platform offers an option debit card called a cash card to allow spending money in the cash balance and receive “cash boosts”– savings that are applied on many vendor merchants.

How Does Cash App Works

Once you have downloaded the cash app on your mobile or tablet, users can register accounts and link their bank account and payment cards. Once the cash account is set up, the user can start making transactions, invest in stocks, and buy & sell bitcoins.

Advantage Of Cash App

- Free Optional Debit Card

- “Cash Boosts” to save money

- Invest in Stocks and buy/sell bitcoins

Disadvantage Of Cash App

- Charge fee for sending money using credit cards

- Fee for instant deposits

Wrapping Up

In P2P payment apps, Venmo is one of the best trending and user-friendly apps. It has a considerable revenue model and growing day by day with offering enhanced features. Also, the users of this platform find it easy to use for money transfers and splitting bills. So, if you have any doubts or questions in mind, Let’s reach out to us!

USA

USA UK

UK Singapore

Singapore