Last Updated on January 21, 2022

For a very long time, the finance industry has been multiple technologies for serving their clients in a better way. Fintech is a newly coined term that is for anything comprised of finance and technology from the platform of transferring money to budgeting apps. It is one of the fastest-growing technologies across the globe as it offers top-notch security and convenience of traditional practices of finance. In 2020, the Fintech market valuation was $127 billion. As per the Business Research Company, by 2022, it will reach the valuation of $309, 98 billion with a CAGR of 24.8%.

Despite being a very complex industry, Fintech is becoming popular and is replacing traditional modes of e-commerce, payments, banking, and wealth management. With Fintech, business owners and professional accountants to easily manage their accounts. Thus, in this article, we will know all the aspects of the Fintech mobile application development including the meaning of Fintech, types of Fintech apps, features, and how to create a Fintech Wallet app.

What Is A Fintech App: An Introduction

Financial Technology (Fintech) refers to any web or mobile app which aims to improve and automate the delivery & use of financial services. It is helping companies, business owners, bankers and other entities to easily manage their finance operations by utilizing specialized apps and algorithms which can be used on computers or even smartphones. It emerged in the 21st century and initially, the term was limited to the back-end systems of established financial institutions. But now it has been shifted to customer-oriented solutions. Now it includes different sectors such as education, retail banking, stock market, investment management, etc.

Types Of Fintech Apps

Fintech comprises technologies and financial sectors like blockchain, banking platforms, and budgeting apps. If you want your development to understand your idea, you have to determine the value of a product to consumers. There are different types of apps involved in Fintech:

Insurance Mobile Apps

As the name indicates, these apps are for the insurance industry for speeding the claim processes, policy administration, and reducing fraudulent activities. It can be even a basic CRM for an insurance website. Some of the common features of an insurance app should be payment processing, claims filing, quotes, policies, searching policies as per different parameters, etc. A few categories for which you could develop an insurance apps are:

As the name indicates, these apps are for the insurance industry for speeding the claim processes, policy administration, and reducing fraudulent activities. It can be even a basic CRM for an insurance website. Some of the common features of an insurance app should be payment processing, claims filing, quotes, policies, searching policies as per different parameters, etc. A few categories for which you could develop an insurance apps are:

- Life Insurance or Personal Insurance

- Auto Insurance

- Home Insurance

- Property Insurance

- Marine Insurance

- Fire Insurance

- Liability Insurance

- Guarantee Insurance

- Disability income insurance

- Health insurance

- Auto insurance

- Renters insurance

- Identity theft protection

Here are some good references that you can consider for developing an insurance app:

Geico Mobile

It is an auto insurance app with core features like digital ID cards for assessing insurance policies, a virtual assistant for answering policies or other queries, a parking locator which can find parking for users and allow them to a made reservation.

It is an auto insurance app with core features like digital ID cards for assessing insurance policies, a virtual assistant for answering policies or other queries, a parking locator which can find parking for users and allow them to a made reservation.

Lemonade

The Lemonade app is specially curated for homeowners and renters. Its USP is that it takes a maximum fee for running a business over any premiums that get distributed between different charities during a year.

The Lemonade app is specially curated for homeowners and renters. Its USP is that it takes a maximum fee for running a business over any premiums that get distributed between different charities during a year.

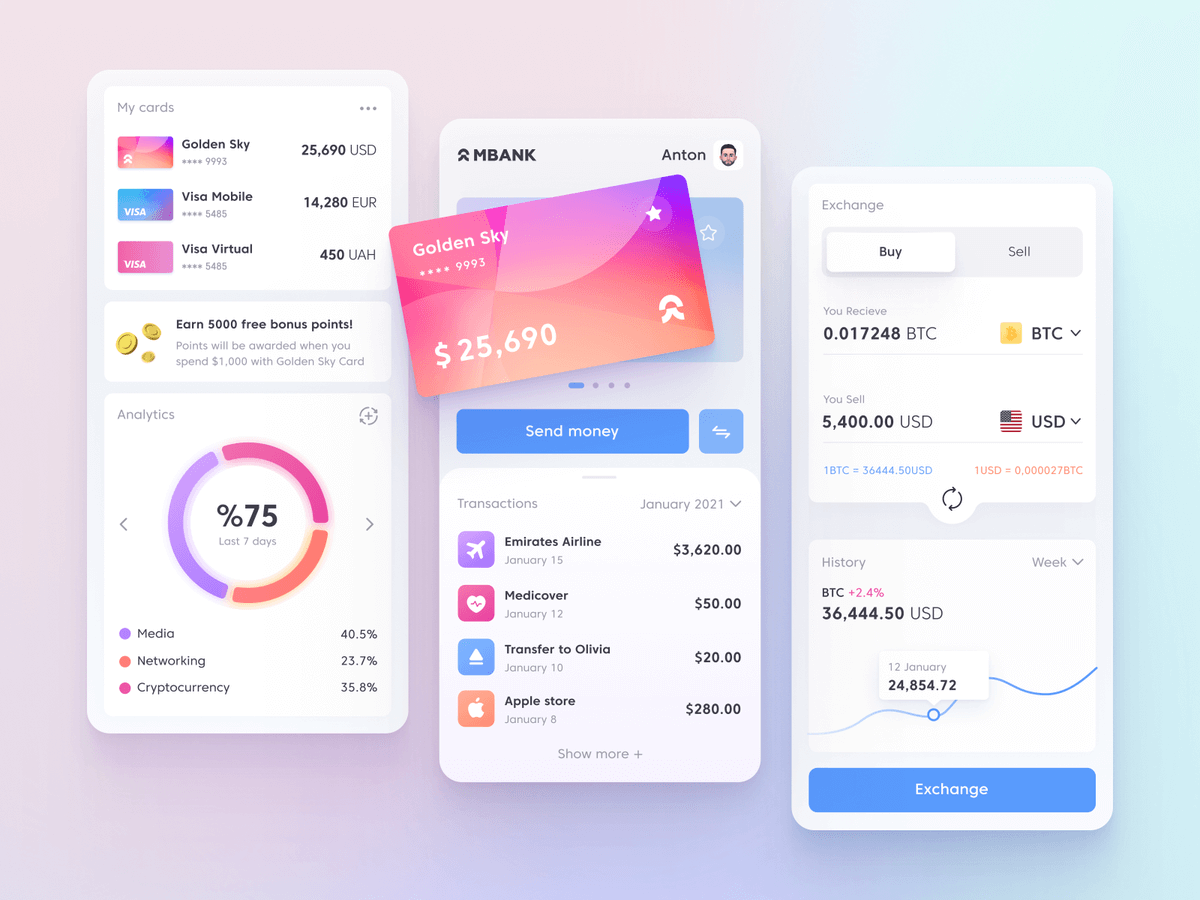

Investment Mobile Apps – For Stock Trading, Mutual Funds & Cryptocurrency

These apps are mostly used in the stock market. Using these apps users can’t just research assets and invest in them but it can also increase the efficiency of investments. If you want to create an investment app, then you have to include core features such as multi-currency, savings, credit management, comparison of assets, real-time notifications, and client support. Some ideas for an investment app are:

These apps are mostly used in the stock market. Using these apps users can’t just research assets and invest in them but it can also increase the efficiency of investments. If you want to create an investment app, then you have to include core features such as multi-currency, savings, credit management, comparison of assets, real-time notifications, and client support. Some ideas for an investment app are:

Robinhood

Robinhood is a trading app with features such as quick access to the stock page, a trading quick start by the instant delivery of the first $1000 deposited into the account, and a news blog channel.

Robinhood is a trading app with features such as quick access to the stock page, a trading quick start by the instant delivery of the first $1000 deposited into the account, and a news blog channel.

Wealthbase

It is amongst the best games apps on the stock market. It combines stock picking and social media, so you can see a feed of stocks your kith or kin are choosing.

It is amongst the best games apps on the stock market. It combines stock picking and social media, so you can see a feed of stocks your kith or kin are choosing.

Also Read: How To Develop A Stock Trading App

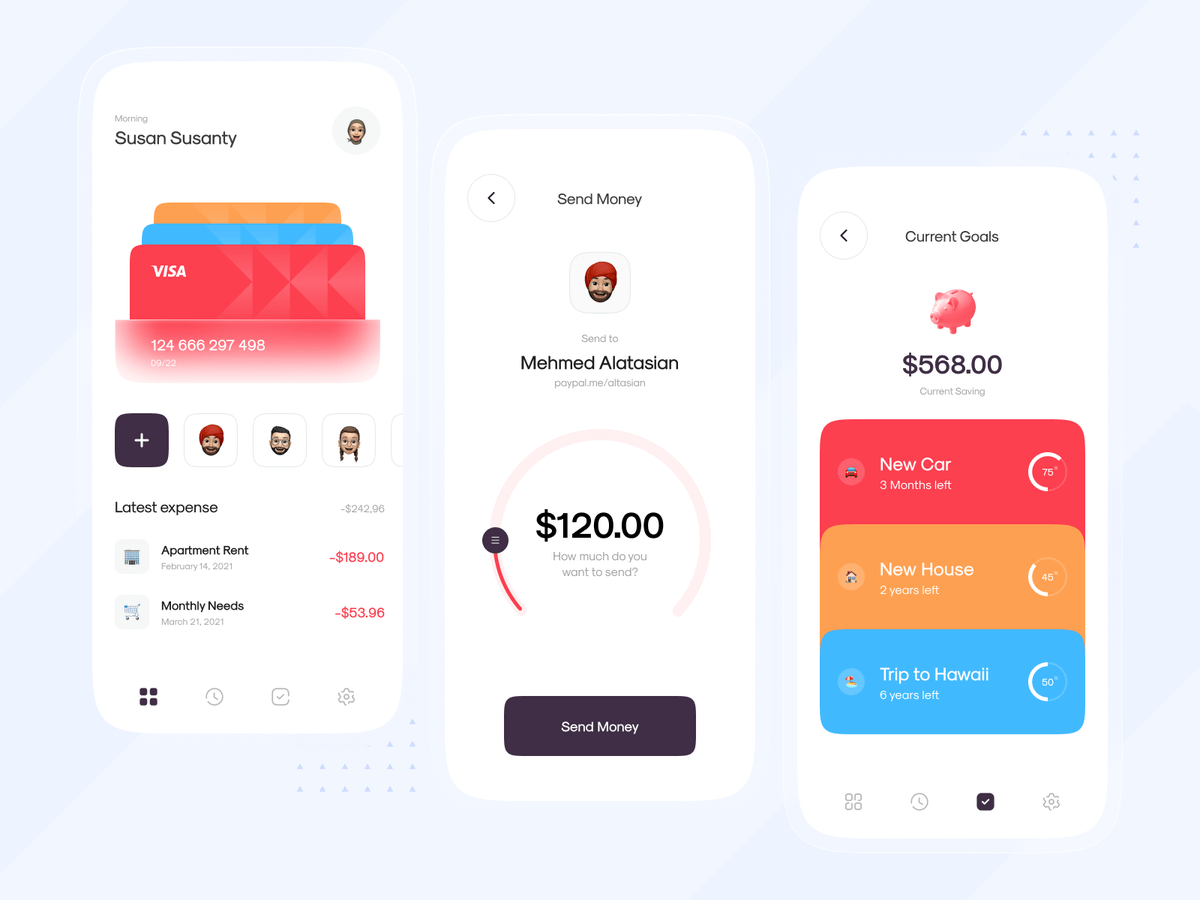

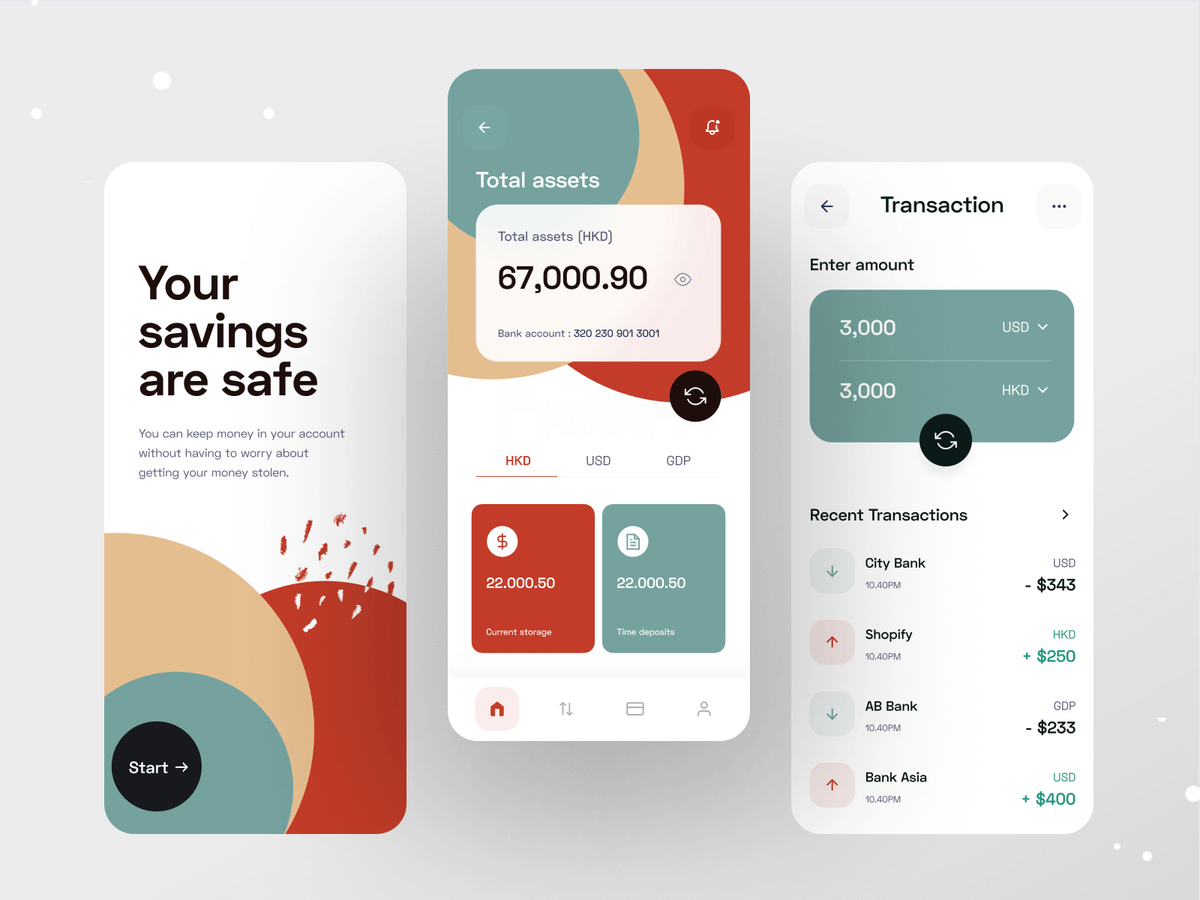

Banking & Money Management Mobile Apps

Banking apps allow users to quickly manage their bank accounts and check financial transactions without going to bank premises. Generally, mobile apps are the first choice of banks as people prefer to use mobile phones for financial transactions.

Banking apps allow users to quickly manage their bank accounts and check financial transactions without going to bank premises. Generally, mobile apps are the first choice of banks as people prefer to use mobile phones for financial transactions.

In a banking app, you can use payment systems such as Google Pay, Apple Pay, or Paypal. The best references for ewallet apps are:

Starling

In Starling, the customers can open accounts without any fee, and without any documents. They can manage overdrafts, savings, create a budget, and transfer funds to other accounts.

In Starling, the customers can open accounts without any fee, and without any documents. They can manage overdrafts, savings, create a budget, and transfer funds to other accounts.

Monese

This UK-based app is for ex-pats who have recently moved to the UK. They can open an account from anywhere within the European continent and UK even if they don’t have a UK address, credit history, and fixed income.

This UK-based app is for ex-pats who have recently moved to the UK. They can open an account from anywhere within the European continent and UK even if they don’t have a UK address, credit history, and fixed income.

Regtech Apps

Regtech stands for Regulatory Technology. These apps are used by companies to meet compliance with the law stated by regulatory bodies. They can monitor tasks, regulatory changes, transactions, reducing false non-compliance alerts, and build reports. In these types of apps, you must give attention to include the ability to identity and risk management, and financial crime identifications. Here are the best good Regtech app examples:

Regtech stands for Regulatory Technology. These apps are used by companies to meet compliance with the law stated by regulatory bodies. They can monitor tasks, regulatory changes, transactions, reducing false non-compliance alerts, and build reports. In these types of apps, you must give attention to include the ability to identity and risk management, and financial crime identifications. Here are the best good Regtech app examples:

6 Clicks

6 clicks automate and manage risk identification, assessment, and analysis of all stakeholders of the risk management lifecycle.

6 clicks automate and manage risk identification, assessment, and analysis of all stakeholders of the risk management lifecycle.

Passfort

Passfort follows the KYC (Know Your Customer) Principles for automating compliance checks. It allows you to transform CLM (Closed Loop Marketing) processes into digital automated onboarding tasks.

Passfort follows the KYC (Know Your Customer) Principles for automating compliance checks. It allows you to transform CLM (Closed Loop Marketing) processes into digital automated onboarding tasks.

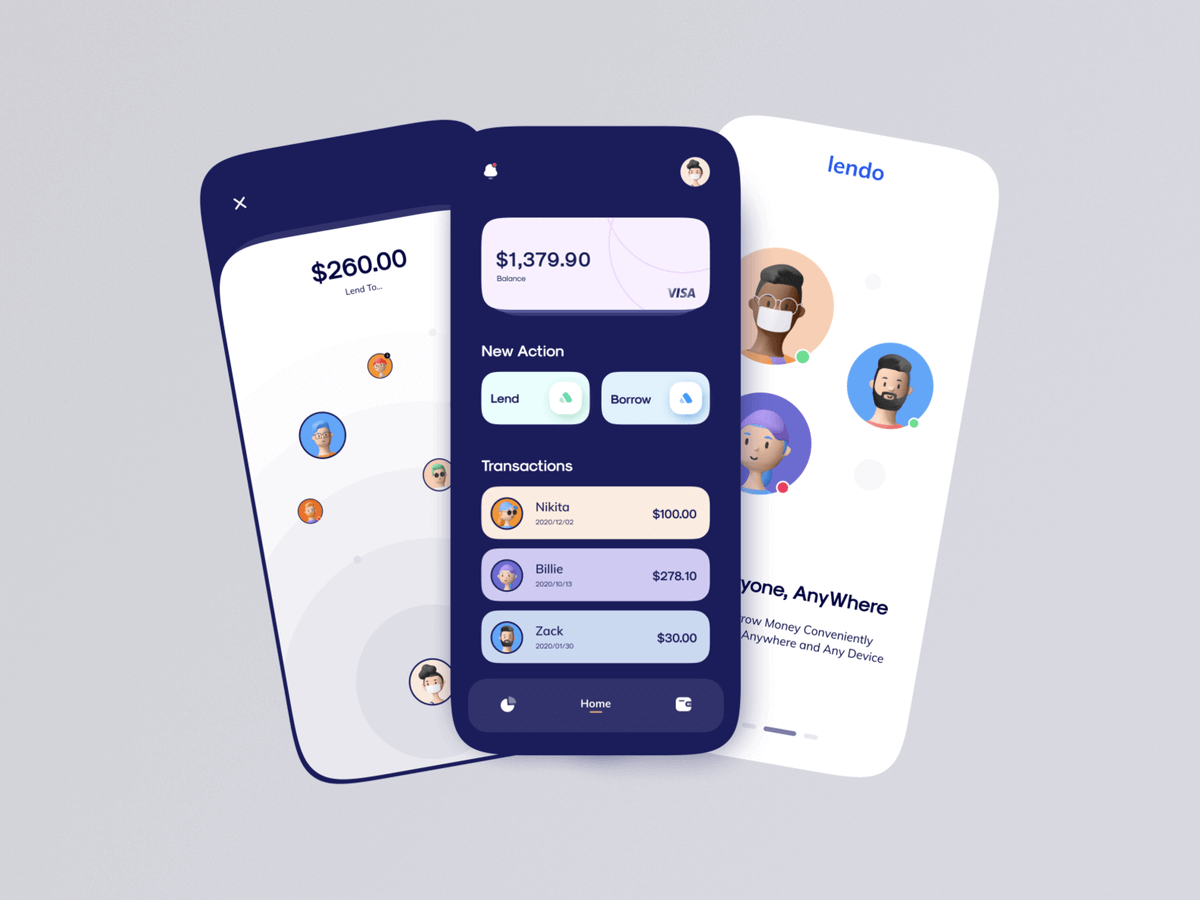

Lending Apps – Money Lending Mobile Apps

The lending apps allow you to lend money without the involvement of a traditional bank or credit union. You just can lend money sitting on your armchair. They have become amongst the most trending tech in the Fintech world. There is no participation of intermediaries such as loan brokers, banks, or any other financial institution. As there are no intermediaries, the interest rate is not as high and investors gain more profit. They have features such as credit score, loan application form, billing, payment, etc.

The lending apps allow you to lend money without the involvement of a traditional bank or credit union. You just can lend money sitting on your armchair. They have become amongst the most trending tech in the Fintech world. There is no participation of intermediaries such as loan brokers, banks, or any other financial institution. As there are no intermediaries, the interest rate is not as high and investors gain more profit. They have features such as credit score, loan application form, billing, payment, etc.

The examples of popular money lending apps are:

Earnin

Earnin charges very low fees and that’s why it is a leader in the Fintech industry. This app stands out as it doesn’t charge any fee when you borrow money.

Earnin charges very low fees and that’s why it is a leader in the Fintech industry. This app stands out as it doesn’t charge any fee when you borrow money.

PaySense

On this app, the salary professionals can get short-term personal loans within 5 hours after applying for a loan. The interest rates are very affordable with very convenient EMIs.

On this app, the salary professionals can get short-term personal loans within 5 hours after applying for a loan. The interest rates are very affordable with very convenient EMIs.

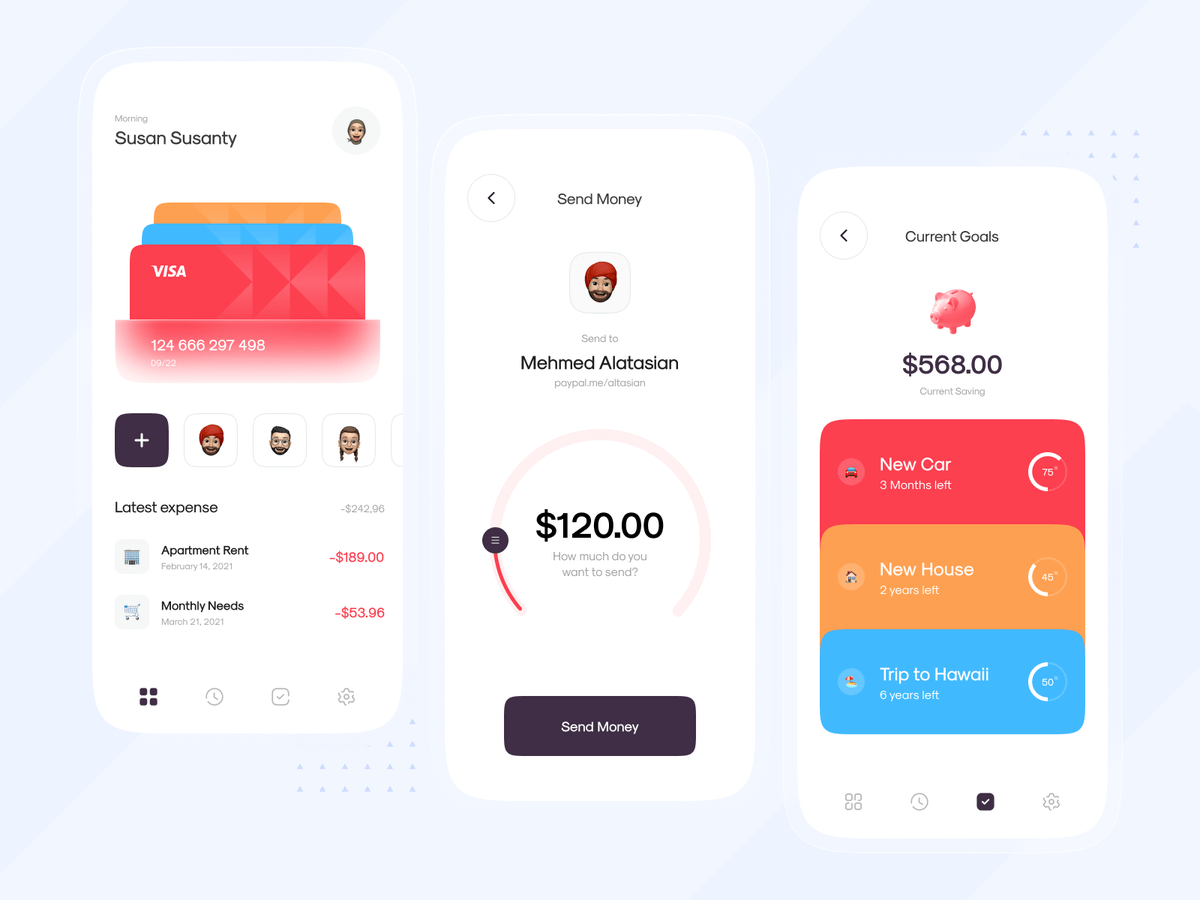

Consumer Finance Apps – Budgeting & Personal Finance Mobile Apps

These apps don’t necessarily come with payment processing services. These apps help users to manage their expenses, save money, and forecast future expenses so that they will not spend more than planned. The common features in these types of apps are financial goals set, expenses and bills tracking, investments analysis, fraud alerts, etc.

These apps don’t necessarily come with payment processing services. These apps help users to manage their expenses, save money, and forecast future expenses so that they will not spend more than planned. The common features in these types of apps are financial goals set, expenses and bills tracking, investments analysis, fraud alerts, etc.

Here are some considerations for consumer finance apps:

Mint

This app is free to use and allows for budgeting, tracking payments, and enrollments. You can make it sync with credit cards, bank accounts, and PayPal.

This app is free to use and allows for budgeting, tracking payments, and enrollments. You can make it sync with credit cards, bank accounts, and PayPal.

Money Patrol

This app lets you manage your transactions, savings and will help you to make wise financial decisions, reveal fraudulent transactions, and much more.

This app lets you manage your transactions, savings and will help you to make wise financial decisions, reveal fraudulent transactions, and much more.

Major Requirements Of Fintech App Development

As we already know, the Fintech ecosystem is quite complex thus you have to initially consider the features which will help you to succeed in your startup. Here are the major features of a Fintech App Development:

1. Security

In the Fintech industry, security is the foremost concern. If users face security issues even once, they will not blink an eye while uninstalling your app. Some of the important features which will enhance security in your Fintech app are:

- 2-factor authentication

- Fingerprint or Face Scan security

- Login through OTP

- Dynamic CVV2 Codes

You should make your app penetration testing for ensuring the system’s security. You will come to know how hackers can break into your app, and then brainstorm for the steps to prevent it. Also, you should update, maintain, and check the app for security.

Remember, there are certain regulations in the Fintech industry. If you have decided to develop a Fintech app, then you have to comply with the app with regulatory measures such as PCI-DSS, PSD2, FCA, and privacy laws like CCPA, GDPR, or PIA. The security techniques should be implemented in the initial phase of the Fintech app development.

2. Integrations

The foundation block of building a fintech app is API. Application Programming Interfaces or APIs can link different apps or portals to each other. In the Fintech industry, APIs can issue commands to 3rd party service workers.

API is also cost-friendly. Suppose you use Plaid API in your app, then this Fintech technology company will allow connecting the apps to bank accounts. Thus users can interact with their bank accounts, check the balances, make payments, and much more.

APIs are responsible for the smooth payments, checkout processes in the e-commerce industry as well. You can integrate your Fintech app with payment methods like PayPal, Braintree, Stripe, etc. so that the customers can do shopping from any corner of the world.

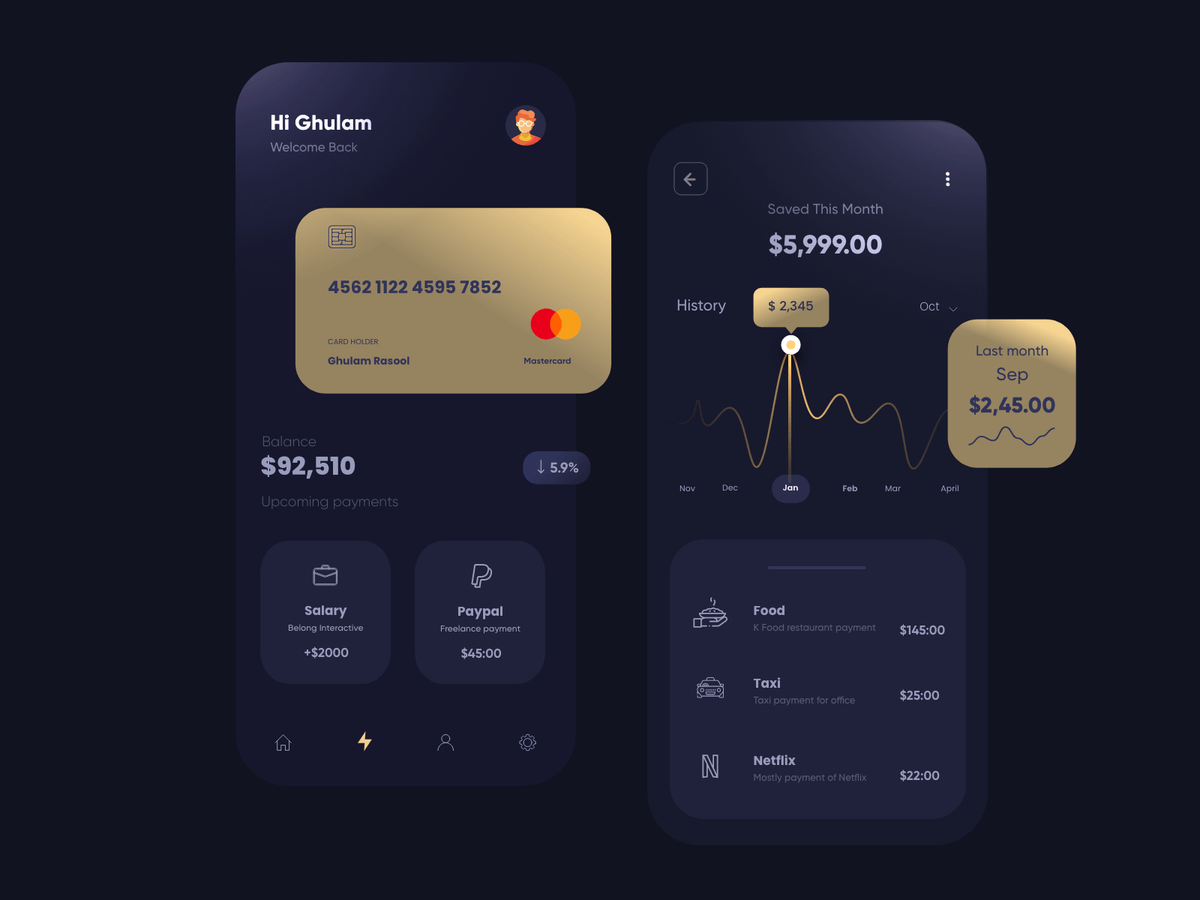

3. Simplicity

If you want your Fintech app to succeed, then make it simple with a user-friendly design. The Fintech users don’t need to delve a lot to use your app. The idea of fintech app development is to create analytical tools for collecting financial data and creating financial programs with a simple interface.

There are real-time analytics and statistics which always display so that the users or companies can easily discover their revenue, expenses, savings, etc. For attracting more audiences, the Fintech app should be simple and intelligible.

4. Support

The whole Fintech industry involves the use of highly confidential data. Thus, you can’t rely on any 3rd party customer service instead you must have consultants to handle customer queries. They should be trained technically to operate under very strict safety rules and requirements.

If you are not able to hire a team who is available 24 x 7 then create a chatbot. Thus, users can trust your app and can find out about their finances or bank’s offers.

Fintech App Development Stages

For developing a Fintech app, you will require very high technical knowledge. You must hire a mobile app development company who is having expertise in building such apps. Let’s know about the major stages which are involved in the Fintech app development. The stages are:

- Choose a Fintech niche

- Deal with Compliance

- Features Consideration

- Make a project team

- Create the App’s Design

- Develop an MVP

- Quality Analysis

Let’s know about each stage in detail.

1. Choose A Fintech Niche

First, you have to decide in which Fintech niche you want to enter. You can start with analyzing the target market, and then decide whether you want to develop a Fintech solution from scratch or improve an existing Fintech solution such as UX improvement, adding new functionalities etc.

If you want to sustain yourself in the competitive world of Fintech, it would be better to develop a complex Fintech solution. You have to be unique. After deciding the niche, you have to legalize the app.

2. Deal With Compliance

As we mentioned above, there are many Fintech legalities that you have to consider from the first phase of your app. The financial protection systems such as KYC, AML are designed to track compliance. You should also comply with the privacy laws (CCPA, GDPR, LGPD, PIA) to make sure that the financial data of users is protected and has limited access.

The privacy law choice depends upon your region, even in some countries there are no specialized regulatory bodies. You have to consider the requirements as per the region of your target audience. For instance, there isn’t a Fintech regulator in the USA but you have to comply with many state and federal laws. Legal requirements are not something you can take casually, if a breach occurs, you will be liable for questioning.

3. Features Consideration

The features of the Fintech app depend upon its type. Analyze the requirements of your target audience. You can create a Fintech app based on an existing solution and think about how to make it better. Still, some features are common that you can consider:

- Highly Secure Login: Fingerprint, facial or voice recognition

- Push Notifications

- Tracking of budgets and savings

- Financial operations such as transferring money, digital payments, checking balance, etc.

- Card Number and QR code scanning

- Virtual assistant or an AI-powered Chatbot

- Unconventional financial services like buying gift cards, donations, etc.

- Cashbacks, Offers, and Deals

4. Make A Development Team

Generally, the best and most fruitful way of Fintech app development is to outsource because it will not just save your time and money but you will get a team of highly experienced developers. They will be answerable to all your queries and meeting all the defined requirements of the scope.

The size of the team will depend on timing, technology, and project size. For instance, for developing a cross-platform Fintech app for both iOS and Android platforms, you will require Flutter or React Native developers. The development process will take more time but you will get 2 apps for two different platforms at once.

A Fintech app development team comprises of these

- 2 Developers (Frontend and Backend)

- Business Analyst

- Project Manager

- Designer

- QA Specialist

While hiring a team for developing your app, check the experience of the company in the fintech industry, hourly rates, and experience of the developers. Communication with the project manager is equally important, thus language fluency also matters.

5. Designing Of The Fintech App

After the security, the design will play a major in attracting the users and retaining them on your app. Make an appealing yet simple design so users have a smooth usability experience.

E.g., if you want to make a banking app, then don’t make large forms that customers will find strenuous to fill for paying bills. Also, there must be an option by which users don’t need to enter payment details for transferring money or paying the bill.

6. Develop An MVP

Minimum Viable Product or MVP development would be a good decision to identify whether your idea will succeed in the market or not. MVP consists of basic features of the app and development without extra costs and saves money. If it succeeds in the market then you can include advanced features in the app.

7. Quality Analysis

After the launch of your app, things don’t stop. You have to conduct an A/B testing stage for checking the reviews of your users, based on which you will include new advanced features and improve existing ones.

If you want to lag your competitors far behind, then your Fintech app should run smoothly, securely, and easily adaptable for users.

Also Read: Mobile app development cost

Why Choose Emizentech?

Emizentech, a top-notch mobile app development company in South-East Asia, having experience in developing top-notch Fintech apps for nearly 10 years. We always sign a well-structured NDA with our clients thus can’t share about our existing projects.

We have highly talented and experienced mobile app developers, project managers, QA analysts, designers, and other team members who will not just develop an astonishing Fintech app but will also help you in the initial business consultation. Let us know your requirements.

USA

USA UK

UK Singapore

Singapore