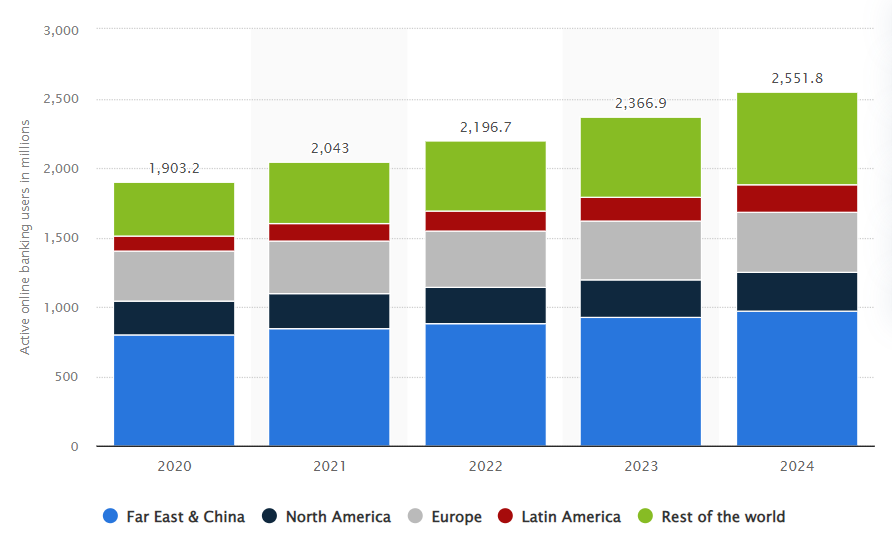

Mobile banking application development services cover the creation and implementation of apps that let users send money, receive money, and handle other financial transactions using mobile devices. By 2024, 2.5 billion individuals will have actively used online banking services, up from 1.9 Billion.

You’ve come to the correct spot if you’re seeking information on banking mobile app development that will connect with the audience or identify a specific user requirement that necessitates mobile services. You’ll discover many more things, as well as the many features of financial application development.

Online Mobile Banking Overview

The banking sector has steadily transitioned to a more technically advanced, safe, and advanced form of payment due to the extensive usage of the internet during the past ten years. The ability to conduct banking activities at your fingertips has become a reality. All you require is a smartphone with a connection to the internet for online banking.

Mobile banking offers free access to various services, including bill pay for utilities, account balance checks, and transfers between different profiles. Mobile phones are used to perform mobile banking, a subset of online banking. This system has made people’s lives easier, saving them cash, time, and unnecessary work. All they want is reliable internet connectivity and a smartphone. Through a simple smartphone app, you have power over the whole bank.

Purpose Of Mobile App For Online Banking

Banks reduce operational costs, increase product sales per client, and increase user acquisition and retention. Startups generate, on aggregate, 10-15% of the investment money annually when they sell to banking institutions or become banks. You must have a banking application on your mobile, and the following are some reasons why:

- In 2019, mobile traffic will account for 63.4% of all traffic, showing an even bigger trend away from desktop utilization. – Statistics.

- According to 36% of users, mobile banking remains their most preferred activity. Statista indicates that every third person holding a smartphone checks, deposits or sends money.

- Mobile apps are often used more frequently by Millennials than by previous generations. You should pay attention if your solutions are targeted toward younger people.

- According to 33% of participants, using a current bank’s user experience is the main reason they stick with it.

This is it, so if you work in the industry, you already understand it better. And lesser credit unions and banks engage in a catch-up game to keep clients. All of these are valid reasons to build a mobile banking app.

Trends Transforming Mobile Banking in Fintech Industry

What are the points of mobile banking applications? Here are the results following our study examining the best mobile apps in the market:

1. Full-Fledged Assistant

Mobile banking applications now provide consumers with so many functions that they take the place of a trip to a banking institution;

2. For More Experienced Users

Financial companies may provide customers with far greater customization and a wide range of app capabilities for administration and management because millennials are so interested in banking apps;

3. Contactless Payment

The application must provide a rapid payment method like QR code Scanner and NFC.

Example:- during an epidemic like covid-19 contactless payment was a must; user can pay without making direct contact with their fintech mobile apps.

4. Improved Cybersecurity

A developing trend in the market is offering sophisticated users two-factor verification and other security procedures in banking applications, such as facial recognition and voice payments. This function can be improved for processing payments due to the widespread usage of voice recognition;

- Chatbots- Customers are increasingly choosing to use chatbots to receive answers to their concerns rather than calling customer support every time an issue arises;

- Interoperability With Third-Party Services- Finally, you may provide a customizable system of rewards to customers who use the solutions of your associates.

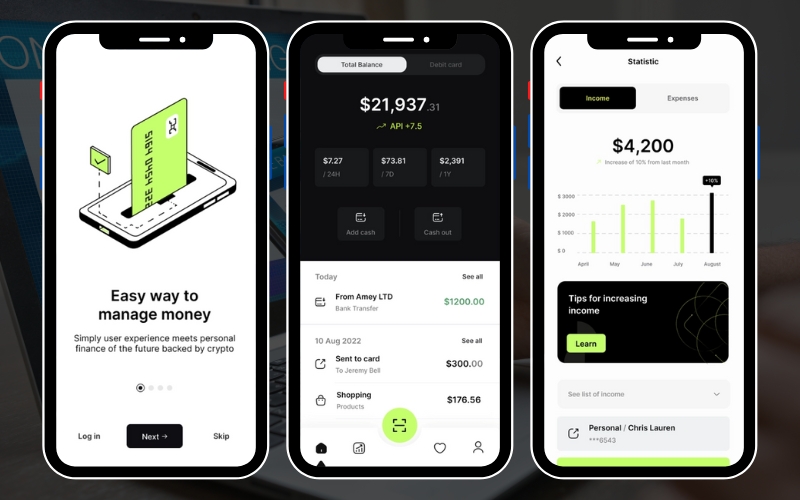

Feature of Mobile Banking App

If you’re starting from scratch, your app ideas better meet customer requirements. Additionally, they have had lots of time to develop them. The following fundamental characteristics are what the average person expects from a modern bank account.

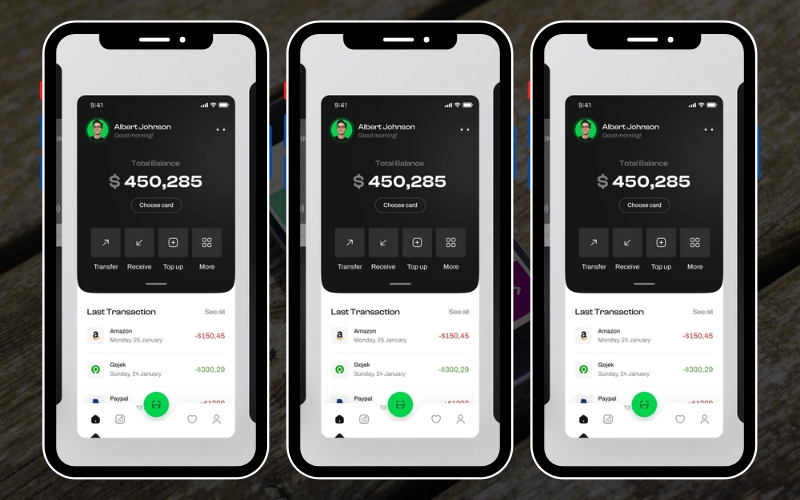

1. Transactions & The Balance

A bank-produced mobile app’s main features are balances that can be seen at a glimpse and previous transactions. Showing users what they possess and making it easy to locate and recognize transactions is typically the first element they want after installing an app.

2. Payments

Since mobile payments, everyone enjoys banking from their couches. Connect with several service suppliers to allow your consumers to settle debts, pay for daily costs, and send money to relatives and friends. They ought to be capable of paying for anything, in principle.

3. Pay a Check

Another useful function prevents your customer from having to go to the bank to deposit a cheque. Instead, they approve the check, take a snapshot from both ends, and submit it using the app.

4. Using Push Notifications

Nobody wants to miss these alerts. Alerts may also request authorization for a scheduled activity, which consumers may provide with a simple touch in addition to providing financial status reports. That is the ideal method for encouraging someone to register for automatic pre-scheduled payments.

5. Control Cards

Users should have access to all of the features that their banks allow, including disabling their payment method, allocating them to another account, setting restrictions, modifying their pin, and more.

6. Biometric Verification

Particularly when it pertains to personal finances, security is all. Make your consumers feel safe and convenient at the exact moment by introducing the capability for fingerprints and faced sign-in. And everyone prefers to tap or quickly scan their phone to sign in.

In contrast to other applications, mobile banking design necessitates a strong emphasis on privacy protection. The security step should thus be incorporated into the procedure.

7. Expense Management

The majority of popular banking applications for smartphones display charts or bubbles that categorize the user’s spending. In contrast, side, if you’re just getting started, it’s unlikely that your consumers require that.

8. Innovative Features

Let’s say you want to design a mobile banking app that would stand out from the competition. If so, think of some distinctive traits that might add value. And if you intend to rise to the top, at the very least, consider including the following capabilities.

9. ATM Users Without A Card

It’s a huge thing to be able to make a cash withdrawal if you leave your cards in your vehicle. Some applications will allow you to use ATMs even if you would not have a card by using QR codes or another method of communication.

10. Utilize More Bank Interest

You may gain the most value per client by having simple access to the remainder of the bank’s offerings via a mobile app. During the same time, clients don’t need to travel to a real office; they may apply for a loan immediately then and there.

11. A Voice Assistant or Chatbot

A powerful chatbot or virtual assistant might be the icing for your app. According to their statistics, only 1% of bank of America’s 27 million+ mobile clients switch off erica, the company’s ai-enabled chat and voice assistance.

12. Custom Warnings

You may improve the application with notifications that activate depending on certain parameters and recurring messages notifying customers about their most transactions made and balance condition. Such warnings will appear when certain transactions exceed their daily or monthly expenditure caps.

Hire Professional Mobile App Developer

Connect to Develop the Best Online Banking Mobile App

List Of Stakeholders For an e-Banking App

| For Big and Small Banks | By offering mobile banking services to private and business clients, relationships may be formed and maintained. |

| For Local Banks | Go out to clients that live in rural and distant places. Adapt characteristics and capabilities to meet the needs of neighborhood businesses. |

| Credit Unions | Allowing to use of services for mobile banking will increase the happiness of union employees. |

| For De-Fi Businesses | You may give users a smooth crypto payment process by allowing them to exchange bitcoin assets through a mobile banking app. |

How Does Mobile Banking Help Finance Institutions?

Mobile banking would be a safe, decentralized financial option that benefits clients and financial organizations. Let’s talk about how mobile banking is assisting financial organizations.

- Secures The System: Biometric security technologies like voice commands, face identification, and fingerprint locks safeguard the financial system. Only approved bank owners will be able to access their accounts as a result of this, preventing unauthorized access to the system.

- Less Work For Workers:– Staff is under reduced workload when more financial sector procedures are digitalized. They become more effective and productive as a result.

Banks may use fewer resources and save money using technologies like blockchain, ML, and AI. Artificial intelligence (AI)-enabled chatbots and other features reduce the demand for customer support professionals.

Modern Transactions Solutions in A Banking App?

There Are Several Categories of Mobile Banking Software.

1. Near-Field Interaction (NFC)

Banking firms may now utilize a user’s smartphone to conduct cashless transactions due to this relatively new technique. To authenticate the transaction, the ITS OS also demands the client’s fingerprint;

2. Digital Wallets

Digital wallets save a user’s credit card information, negating the requirement to utilize the physical copies of such cards. Typically, they are combined with Quick Reply (QR) NFC technologies.

3. QR Code Scanner

Using a smartphone QR code scanner, you may clear out items at physical stores and pay bills based on the produced list of items;

4. Internet Transactions

The mobile payment system is available through most banks’ smartphone platforms, which enable online payments using reputable payment processors like PayPal or Stripe. This kind of virtual bank software gives users complete control over all bank card-related transactions. Therefore, a trip to the bank is typically not necessary.

Step-by-Step Guide for Building a Banking Mobile App

Creating a smartphone banking app is essentially the same as creating any other product, except for the necessity to give security greater attention. A few procedures for creating an online mobile banking app are detailed here. Look them up.

1. Research

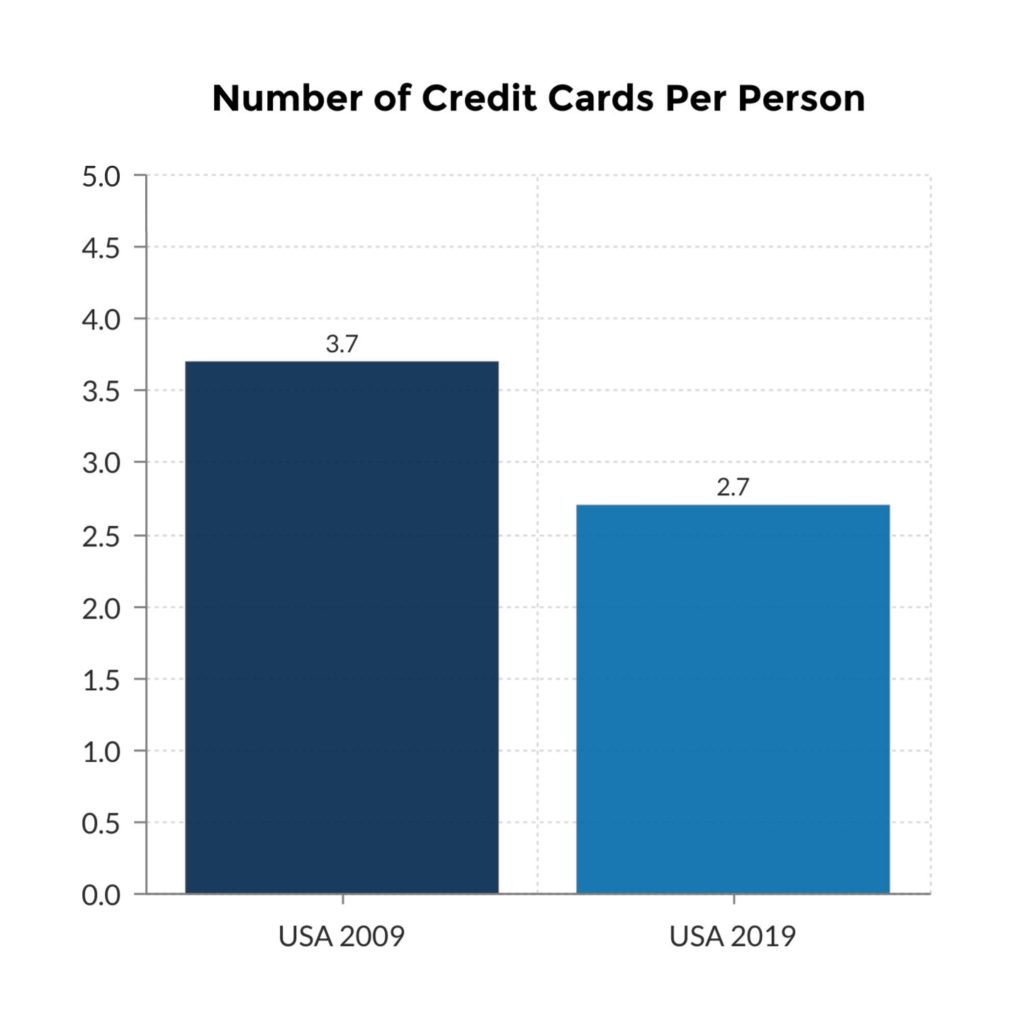

We advise focusing on the cultural element, psychology, and user behaviors while developing mobile banking. For example, we discovered that 70% of Americans held at least a single credit card when we developed a mobile banking app for the American market. Therefore, the issue of whether to provide a credit option never came up. Rather, it was a necessary feature. Therefore, be mindful of the cultural aspects of the marketplace you are entering.

The Outcome of The Research Phase Is as Follows:

- Personas For Users

- Market Research

- Industry Share

- Market Customs

- Value Proposal.

2. Establish the Foundation for Security

Customers want the highest level of security, whether you’re a conventional banker or a startup aiming to resuscitate mobile banking. They are entrusting the program with their cash, after all. Therefore, you must create a secure mobile app for mobile banking.

A recent study conducted by good Innovations for many major banks on the risks and flaws present in mobile banking systems has led to the publication of their results. They have learned that:

- Attackers may access user information from the client side in 13 out of 14 apps.

- 76% of vulnerabilities may be exploited without additional access to the tools.

It would help if you educate clients (and your staff) about cybersecurity quality standards and protecting your application and the server side. On the app’s end, you should think about the following:

- The obfuscation of source code to prevent hackers from being able to decompile an app and extract data for hacking

- The removal of class and method names from the source code

- the addition of safeguards against code execution and repackaging

- Use of SSL and 256-bit encrypted communications

Top-notch security measures that increase the security of an app for mobile banking encompass:

- Frequent password changes

- Two-factor identification,

- And transaction confirmation with a brief code provided through push notification.

Additionally, keep the user’s convenience in mind and incorporate security and usability features:

- Permits quick pin codes for entry and supports authorization

- Customers must frequently change their pins for biometrics and FaceID.

3. Create and Test a Prototype

We have discovered one thing about supply chain management: the number of contacts with a product determines its effectiveness. One of them is creating prototypes.

Consider the working model as a more streamlined form of the finished item. It ought to contain the following:

- App Strategy

- Logic

- And design

To improve the precision, durability, and appearance, the prototype remains far from the finished item. It enables you to verify your hypothesis. Deliver it to actual people, get their feedback, determine what performs and what doesn’t, and make the necessary improvements.

4. Make The App Better Through Integrations

There are additional third-party solutions you might integrate into your app and Plaid. This Application programming interface lets financial apps interact with customer trust funds (with their consent).

Zelle is a prime instance. Many financial applications now provide this functionality to make interbank transfer funds easier.

No matter which bank a person uses, they may send money to relatives and friends with Zelle.

DocuSign is an additional service that you may find handy. It can be simple to design mobile-friendly contracts that consumers can sign directly from their phones. Let us understand what you hope to achieve further with the banking solution you have in mind, and we’ll suggest providers that can help.

5. Develop UX & UI

The design team rolls their sleeves and works using the data we acquired during the preliminary stages, utilization cases, and reviews on the model.

As we previously noted, mobile banking apps’ user-friendly user interface (UI) designs are one advantage. That is why you need to put in a lot of effort. People are afraid of making a mistake when dealing with anything involving their money. My personal experience has taught me this. Every time you move a sizable chunk of money or register for a credit card.

Therefore, choose a competent UX&UI developer who can create a straightforward, understandable, and welcoming design.

6. Create the App

It will help if you choose the development model at the commencement of the stage. Here, everything is quite apparent.

We advocate choosing Native mobile applications over React Native if you’re building an Android or iOS mobile banking app since it’s more secure. Mobile banking applications on iOS require the following tech stacks:

- Swift

- XCode

- Apple SDK

These are the resources of option if you’re wondering how to design a financial application for Android:

- Java/Kotlin

- Google Play Studio

- SDK for Android

7. Update & Maintain

It must be the most satisfying part of the entire journey. Only when you have the ideal software provider can you guide yourself through the difficult maze of the Application Store as well as the Google Play examination process. Also, don’t forget to stress-test your systems to ensure users won’t crash them on the release day.

8. Enhance & Modernize

The program may be enhanced with new features as the client’s business expands and market demands change. You may learn which components of the application could be enhanced with the use of fresh market analysis. So, it is possible to think of the entire process of creating software as cyclical.

What Are the Benefits of Mobile Banking?

Due to the time and energy it costs, mobile banking would be a particularly effective banking strategy. You may almost complete any bank-related task with the help of such companies. Overall, it lessens your reliance on others and improves your financial management. You may benefit much from this streaming platform by using safe habits.

1. Save Time

Your reliance on banks for daily transactions is eliminated by mobile banking, which provides rapid and immediate financial services. Do you wish to quickly transfer money or check your bank account and recent payment details? You only need to download the mobile banking app from your bank to get started.

2. Online Banking

Do you intend to travel overseas or to a different city? All you need, wherever you go, is a strong broadband and smartphone network and a reliable internet connection. Due to mobile financial services, you may carry out many types of transactions from anywhere around the world.

3. Trace the Transactions

You can trace your monetary operations using mobile banking, which is another benefit. By entering your smartphone banking app, you can easily monitor your bank balances and challenge fraudulent activities.

4. Simple Access

You may use mobile payments to transfer money, check financial accounts and bills, or make loan applications, among other things. Using your smartphone’s mobile banking app, you may order checkbooks, register for debit cards and credit cards, create single and regular deposits, and more.

Banks provide customer support services to assist consumers who are having trouble using an app. Customers may contact the customer service team by phone, chat, or email. You can notify fraud during questionable purchases and ban your debit card.

5. Removes Language Obstacles

Many banking institutions provide mobile applications that may be downloaded in many dialects. Most consumers now find it simpler to use mobile payments independently. Because of this, you won’t be as confused as you could be. Due to the active use of these multiple languages banking applications among rural people, the nation is becoming increasingly centered on banking.

6. Continuous Accessibility

Mobile payments are similar to having your bank with you at all times, seven days a week. You may start a money transfer anytime through the smartphone banking app, contact customer service helplines, and get financial information quickly.

7. 24-Hour Banking Services

One of the main advantages of mobile banking is this. As an account holder, you can require money transfers or withdrawals immediately. Internet platforms like mobile payments are extremely important in this situation. Going to a banking institution, standing in line, or putting off a crucial transaction is unnecessary. Through your cell phone, you may accomplish that right away. Even paying your bills is always possible.

8. Value-Added Services

With app-based mobile banking, service payment systems, phone use, insurance plan buying, etc., are possible. You may form a pension account, pay taxes, buy FASTags, and open bank accounts for financial assets, among other things.

Your Fintech App Development Partner

Start Building a Secure Online Mobile Banking App Now

Technology Required to Build Secure Online Banking App

Depending on your type, you might need to utilize the latest methods to submit a bank application.

| Platform-Agnostic Development | Hybrid Apps Development | iOS App Development | Android App Development |

|---|---|---|---|

| Flutter | Ionic | Swift | Java |

| React Native | Cordova | UIKit | Kotlin |

| Xamarin | PhoneGap | Objective-C | Android SDK |

| App code | Android Developer Tools (ADT) | ||

| Xcode IDE | Jetpack Compose | ||

| SwiftUI | Android UI tools |

Cost To Develop Mobile Banking App

A few million dollars with an internal team and $300,000–$500,000 with an external team of contractors. That is a rough estimate of the Cost of creating a banking app entirely from scratch. To get a functioning MVP out, the expense of building your app should fall between $110,000 and $240,000 when you are a finance firm aiming to answer a specific client demand.

For the two types, annual upkeep will correspond to about $100,000 and $45,000. However, the long-term financial plan for this type of app must have a minimum base value of $1 million. The time it takes to build your software will rely on the group working on it and its features. Still, it requires between three and six months, based on its particular functionality.

As an illustration, consider the case of Step. This recent mobile banking company collected $3.8 million in a preliminary round before receiving $22.5 million through Stripe and beginning to develop a mobile banking app with a complete collection.

How to Find the Best Mobile App Developers & Designers

There are two possible alternatives when selecting the best programmers for your internet banking app project: either hire experts as full-time workers or choose the outsourcing growth strategy.

In the event of outsourcing programming, the entire project may be managed under agreement by a specialized design company. Both in-house staff and freelancing or independent contractors must meet the following conditions: they must have appropriate experience in banking technology, have the same beliefs and working environment, and be knowledgeable about the newest technology. Each strategy, though, has benefits and drawbacks.

By outsourcing development services, you may acquire the greatest skills for developing mobile banking apps at reasonable pricing. Additionally, engaging an outside consultant helps your human resources and management staff avoid many issues. Regardless, the ultimate choice should be based on the distinctive qualities of your business, any time or financial constraints, and the app’s total intricacy.

Conclusion

The creation of the application for mobile banking is a massive improvement in customer demands. In the US, iOS has a 59% market share, compared to 41% for Android. Client preferences will influence the decision you make on how to create a mobile banking app. In contrast to other applications, mobile banking design necessitates a strong emphasis on privacy protection. The security step should thus be incorporated into the procedure. It influences the functionality you include and produces fresh difficulties.

However, what thrills us about developing mobile banking applications is when our features and designs work together to elevate the whole customer experience.

USA

USA UK

UK Singapore

Singapore